Trusted by More Than 500 Business Owners

Let Us Be Your One Source for SBA Lending.

Download Current Rate Sheet

Click below to apply for:

Which SBA Loan is right for you?

Getting the capital you need is key to growing your business. Learn more about small business loans to grow your business by choosing the option that fits your situation best.

Request a Proposed Purchase ScenarioSBA 504 Loans

Explore this if you’re buying a business, expanding, refinancing debt or need flexible working capital.

SBA 7(a) Loans

Explore this if you’re purchasing or building commercial real estate or investing in long-term fixed assets.

Conventional Loans

Explore this if you’re an established business with strong credit seeking fast, non-SBA funding.

Equipment Financing

Explore this if you need to purchase or upgrade equipment without tying up your cash flow.

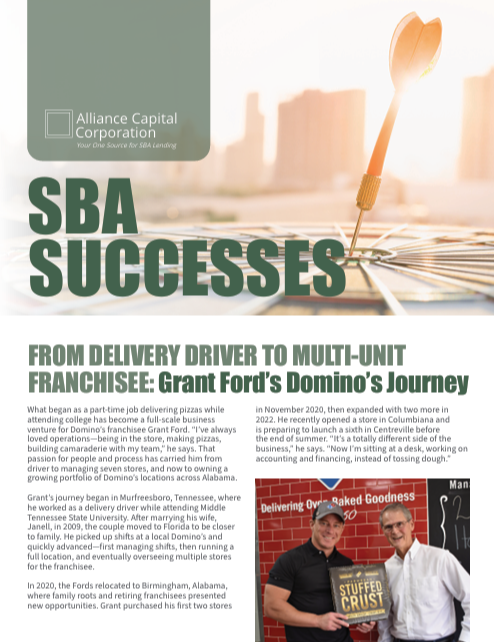

See What's Possible with SBA Lending!

Discover how small business owners are turning bold ideas into thriving ventures with the power of SBA financing. Our SBA Successes newsletter features real stories, valuable insights and the kind of inspiration every entrepreneur can use.

Download Our Latest Newsletter!

What Our Clients Say About Us

We believe building relationships goes to the core of our mission.

"I think anytime you dream big, you think it's a longshot. However, they believed in me just as much as I believed in this concept, and they were there to support me and make sure that they could make this process as easy as possible."

"Restaurants are risky, and for someone to lend a restaurant money is not easy...and Sam, he made it easy."

Frequently Asked Questions

Why Alliance Capital and not go directly to a bank?

How long does it take to process and close an SBA Loan?

Are there a lot of costs associated with a SBA loan?

Are interest rates higher for an SBA loan?

Is a large down payment required to qualify for a loan?

Is a good credit score required to qualify for a loan?

Aren't SBA Loans more for start-ups or companies that can't get conventional financing?

Are the costs comparable for an SBA Loan vs. a traditional bank loan?

Will I have to pledge personal assets, such as my home, to obtain an SBA Loan?

I am looking at purchasing an existing business, is there an SBA Loan for that?

For Lenders

Loan Packaging from Start to Finish

We provide loan packaging services and secure SBA loan authorization for your clients, work with you to close the loan and provide full support for loan sales and servicing after closing occurs.

LEARN MORE

For Referral Partners

Let our decades of SBA experience help your clients

We are a source for SBA lending that believes when businesses grow, it changes the communities around them for the better. Our solutions-minded approach focuses on finding creative loan options in alignment with our client’s goals and needs. We build client relationships through demonstrated experience and results.

LEARN MOREHow Can We Help?

Whether you have questions, or would like to discuss lending options, we'd love to hear from you.

Alliance Capital Corporation

1808 Oxmoor Road

Homewood AL 35209

(205) 982-7900

Join Our Mailing List!

Weekly insights, tips and resources to help you grow your business delivered right to your inbox.